Modern science and technology frequently encounter situations where precise predictions of future events are impossible. Financial markets, molecular motion, weather forecasting, evolutionary processes — all these examples are systems governed by randomness. The mathematics of uncertainty and the theory of stochastic processes provide tools to formalize random phenomena, model them, and analyze probabilistic patterns. Key concepts in this field include random walks, Markov chains, Poisson processes, and Brownian motion. These concepts allow the study of system dynamics where deterministic approaches are insufficient.

Stochastic processes are collections of random variables indexed by time or another parameter, describing the evolution of a system under random influences. Unlike classical mechanics, stochastic processes do not seek the exact position or state of an object but instead estimate the probability of it being in different states. This framework is especially relevant in finance, physics, biology, and computer modeling.

Additionally, stochastic theory helps analyze real-world phenomena under incomplete information. For example, when forecasting stock prices or disease spread, it is impossible to predict every change exactly, but probabilities of various scenarios can be evaluated. This makes stochastic models a practical tool for decision-making and risk management.

Random Walks and Their Properties

Random Walks and Their Properties

A random walk is one of the fundamental types of stochastic processes. It describes a sequence of steps, each chosen randomly, often with equal probability. A classic example is a one-dimensional walk on a number line: a particle starts at zero and at each step moves either +1 or −1 with a 0.5 probability. Even these simple models reveal important properties of randomness, symmetry, and probability distributions.

Random walks possess several interesting properties. For instance, the probability that a particle returns to its starting point depends on the space’s dimensionality: in one or two dimensions, return is almost certain, but in three dimensions, it is not. The root-mean-square displacement grows as the square root of the number of steps, reflecting the typical “spread” of the random process. These properties are widely applied in modeling molecular motion, predicting market price changes, and analyzing randomized algorithms.

Beyond one-dimensional walks, multi-dimensional models exist. Two-dimensional random walks describe movements of animals or insects in a bounded area, while three-dimensional walks represent particle motion in fluids. In each case, researchers study return probabilities, trajectory intersections, and the distribution of time between events, providing deeper insight into stochastic dynamics.

Stochastic processes also allow modeling complex systems with dependent steps. For instance, correlations between consecutive movements can be included, making models closer to real-world situations. In economics, this is crucial for predicting market trends, and in biology, for simulating population migrations or evolutionary dynamics.

Modeling and Practical Applications

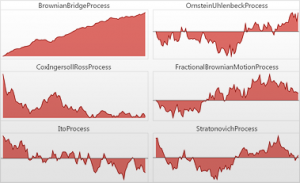

Stochastic processes have applications across diverse fields. In financial mathematics, they form the foundation for modeling stock prices, interest rates, and options. A classic example is the Black-Scholes model for option pricing, which uses geometric Brownian motion to describe the random fluctuations of asset prices. In physics, random walks describe Brownian motion, diffusion processes, and thermal motion of molecules. In biology, stochastic models simulate evolutionary processes, population migration, and epidemic spread.

Computer modeling has become an essential tool for stochastic analysis. Monte Carlo simulations and random number generators allow the estimation of probabilities for complex events, risk forecasting, and strategy optimization. In logistics, stochastic modeling accounts for random supply delays, in network engineering — packet loss, and in robotics — unpredictable interactions with the environment.

Stochastic processes are also applied in social sciences and psychology. Modeling social networks and information spread helps understand rumor dynamics or viral content. In marketing, stochastic models help predict consumer behavior and assess campaign effectiveness, where individual choices are influenced by random external factors.

Table: Examples of Stochastic Process Applications

| Field | Type of Stochastic Process | Application | Example Use Case |

|---|---|---|---|

| Finance | Geometric Brownian Motion | Option pricing, stock price forecasting | Black-Scholes model |

| Physics | Classical Random Walk | Particle diffusion, Brownian motion | Calculation of diffusion coefficients |

| Biology | Markov Chains, Poisson Processes | Population migration, epidemiological modeling | Forecasting virus spread |

| Computer Science | Monte Carlo Simulations | Estimating probabilities of complex events | Algorithm optimization, risk prediction |

| Social Sciences | Random Interaction Models | Information spread, group behavior | Evaluating marketing strategies |

The table highlights the versatility and practical relevance of stochastic processes. They allow formalization of uncertainty, predictive modeling, and informed decision-making in complex systems.

Challenges and Research Perspectives

Working with stochastic processes requires a solid understanding of probability theory, statistical analysis, and handling large datasets. The complexity of modeling increases with multi-dimensional processes or dependencies among variables. For example, financial markets are highly complex systems with interdependent assets, requiring models of random walks to be complemented with correlation structures and stochastic differential equations.

Research prospects include advanced computational methods, artificial intelligence, and machine learning. Modern technologies enable multi-dimensional process modeling, rare event prediction, and risk management. In biology, this allows precise epidemic forecasting; in robotics, adaptive behavior under uncertainty; in finance, optimized investment strategies.

Teaching stochastic processes helps develop analytical and probabilistic thinking. These skills are critical for future experts in mathematics, physics, bioinformatics, financial analytics, and computer science. Understanding randomness and probabilistic reasoning enables not only interpretation of observations but also strategy building, risk minimization, and system management.

Modern modeling techniques include Monte Carlo simulations, bootstrap methods, probabilistic graphical models, and machine learning algorithms. These tools allow exploration of high-dimensional systems, rare events, and adaptive responses. For example, ecological stochastic models evaluate population survival under climate change, while computer networks use them to forecast delays and optimize data routing.

Conclusion

Stochastic processes and random walks are fundamental tools in the mathematics of uncertainty. They describe system dynamics where deterministic methods fail, formalize randomness, and provide models for analysis and prediction. Their applications span finance, physics, biology, computer science, social sciences, and more.

Understanding stochastic processes not only aids in analyzing current events but also in building strategies, reducing risks, and managing complex systems. Modern computational resources make multi-dimensional stochastic modeling more accessible, opening new research and practical applications. Studying random walks and stochastic processes develops essential skills for working with uncertainty, preparing specialists for real-world challenges where predictability is limited and probability-based decision-making is key.